are federal campaign contributions tax deductible

Political contributions arent tax deductible. There are five types of deductions for individuals work-related itemized education.

Can You Deduct Political Campaign Contributions From Taxes Money

Contributions or donations that benefit a political candidate party or cause are not tax.

. Municipal affairs acknowledges that unlike provincial and federal campaign donations municipal and school board campaign contributions are not tax deductible. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations. Can I deduct my contributions to the Combined Federal Campaign CFC.

OPM sent out a message that states. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. According to OPM you can deduct even if you take the standard deduction and do not itemize.

Are Federal Campaign Contributions Tax Deductible. Individuals may donate up to 2900. You can obtain these publications free of charge by calling 800-829-3676.

Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. The IRS has clarified tax-deductible assets. A tax deduction allows a person to reduce their income as a result of certain expenses.

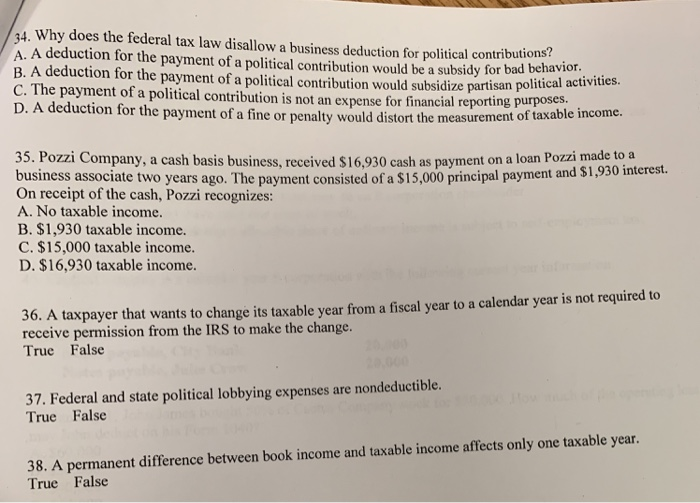

Can I deduct campaign contributions. Resources for charities churches and. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US.

WRONG for 2020. Thank you for contributing through the Combined Federal Campaign CFC. You may deduct charitable contributions of money or property made to qualified organizations if you.

Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. Among those not liable for tax deductions are political campaign donations. You can obtain these publications free of charge by calling 800-829-3676.

Your tax deductible donations support thousands of worthy causes. The CFC is comprised of 30 zones. Data on individual contributors includes the following.

In other words you have an opportunity to donate to your candidate. It doesnt matter if it is an individual. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns.

You cannot deduct contributions made to a political.

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Campaign Finance In The United States Wikipedia

Are Political Contributions Tax Deductible Anedot

Why Even Bother Having Campaign Finance Laws When Enforcement Is A Joke

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Why To Avoid 100 Of Agi Qualified Charitable Contributions

Are My Donations Tax Deductible Actblue Support

Act Now To Lower Your 2021 Taxes Support Columbia S Agriculture Park Build This Town Campaign For The Agriculture Park

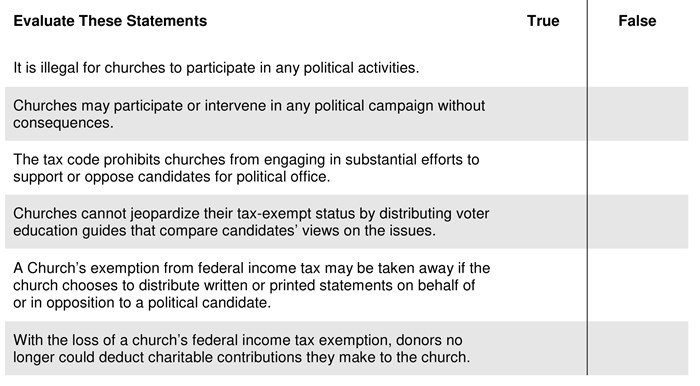

Do We Understand The Effects Of Our Church S Political Activity Church Law Tax

Are Political Contributions Tax Deductible H R Block

Giving Just Got Easier For Retired Federal Employees Habitat For Humanity Of Greater Los Angeles

Campaign Finance Requirements In California Ballotpedia

Fec Candidate Who Can And Can T Contribute

Are Political Donations Tax Deductible How You Can Know For Sure

/GettyImages-627470143-75dfe20367224b7aa373e54654e37917.jpg)

What Happens To Campaign Contributions After Elections

Make A Donation To United States Deputy Sheriff S Association